Jaw dropping infrastructures, lavish buildings and vast deserts are the things which strike our mind thinking about United Arab Emirates. Along with its massive increase in wealth and technological advancement, the country is rapidly leaping towards becoming a cashless economy too. And this is why, in this article, we’ll brief you about the state of online payments in UAE.

But first, let’s shed some light on their popular means of transaction.

What’s the most popular mode of payment in UAE?

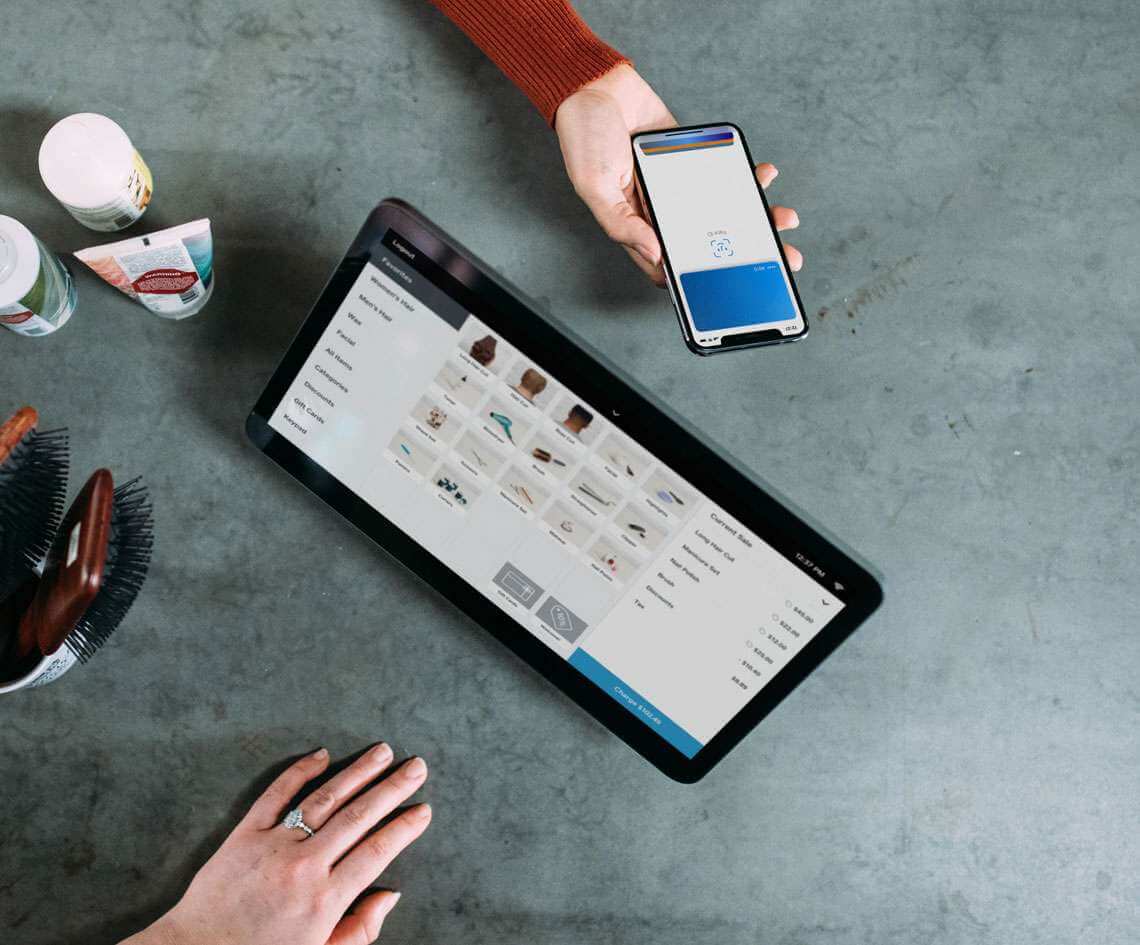

The digital payment system in UAE is experiencing significant growth, in fact in a survey, 92% of those customers preferring cash on delivery would pay by card if a mobile POS machine was available upon delivery. The situation is optimistic as now people are adopting cashless transactions and digital payments at a rapid pace. But it wasn’t the case as recent as 5 years back, wherein 10 out of 12 people preferred paper money for buying groceries and daily utilities.

‘But why did people rely on cash in the past?’ Does this question arise in your mind too? Well in the below section we have tried to answer the same.

How Online Payment eliminated cash altogether

- In earlier times, the issue of ‘security’ used to concern people, so they preferred cash in the past. But fortunately, owing to high speed advancements, such people are now in minority. In fact in a survey conducted a year back, around 84% of surveyed customers consider digital payment highly secure over cash.

- Transaction charges, which can be avoided using cash, were also a big turn-off for people. But now, such charges are only applicable when large payments are processed. And they are almost negligible if bills are paid with internet banking. One more reason to move towards internet banking, isn’t it?

All things said, one thing to note is UAE features among the top countries that are rapidly moving away from cash. With increasing technology, a shift in mindset of people is visible where they are beginning to embrace the pros of digital payment.

Payment methods in UAE & Effect of COVID-19

UAE is steadily becoming a cashless economy. News reports indicate that COVID-19 has been a major factor in pushing people towards adoption of digital payments. People are eager to move to the new normal as they have gained confidence in cashless transaction. In fact, contactless transactions have seen a four fold rise when it comes to payment of groceries, pharmacy among other categories.

There are plenty of methods, starting with plastic cards to the online mobile wallets which are being used nowadays instead of cash. Here’s the list of few payment methods prevailing in UAE.

1. Credit Cards

Credit card’s popularity is more among affluent UAE residents. Almost 71% of them own more than one credit card. The majority of people use credit card to pay their bills and for purchasing day-to-day essentials.

2. Debit Cards

The convenience offered by Debit cards has gripped the UAE residents by allowing them to withdraw money anytime from the ATMs. Though there is no major risk associated with the use of debit cards, people using these cards sometimes fall prey to debit card frauds due to the lack of awareness. Digital literacy has drastically reduced such instances.

3. Mobile Wallet

As the name suggests, your mobile can be your wallet. The craze of this method of payment has seen a slow but steady increase in the popularity in UAE. Digital currency has gained a lot of attention in this COVID-19 period. You don’t have to carry money around; you can pay for products without exchanging paper money. This has reduced chances of spread of the virus.

A good rise in the usage of mobile payment system in UAE is seen due to the interest of the youngsters. A survey showed that people are optimistic about digital payments.

According to estimates, the mobile wallet market is set to surpass US$2.3 billion by 2022 in UAE. The government had introduced its own mobile wallet ‘Emcash’ grabbing attention of many residents.

What is the status of online payment in UAE?

- As mentioned earlier, youngsters are eager to embrace the online payment system; even older people are increasingly inclining towards online payment. The increasing advancements are contributing towards higher reliance on these modern means.

- Data shows the growth of online payment in the country is approximately 30% per year. The past few years have witnessed a steady decline in the proportion of cash-on-delivery payments and a good rise in the online payments has been observed.

How the increase in online payments will help in UAE’s economic growth?

Numerous case studies demonstrate the correlation between increased online payments and subsequently increased growth in a country’s economy. Sweden and South Korea are apt examples of countries that boosted the growth in the economy with a sharp reduction in payment related frauds.

Various digital wallet platforms such as Google Pay, Samsung Pay, Apple Pay, and carved a significant space in our lives. Thanks to such apps, we can take a break from our old wallets and roam free without any fear of being robbed. Increased support and investment into security and functionality of these apps would enhance their penetration over masses. And this would in turn eliminate evils such as corruption, black money not only from UAE, but the whole world.

Conclusion

UAE, with the involvement of online payment systems can reap the benefits of technological advancements. It is largely possible with increased involvement of various state and non-state actors. Though we are showing increased inclination toward adopting the system, there’s still a long way to go.

Related Post

Publications, Insights & News from GTECH